As a self-employed photographer, the scary truth is that you now have a bigger tax responsibility. But the good news is that you are also entitled to deducting photography business expenses from your taxes. In this blog, tell you what business expenses are and what you can write off as a photographer. I also include tips to make your expense reporting easier, such as software and apps to track expenses. Finally, scroll down to the bottom to download a free spreadsheet to track expenses to use for your own business.

Before you get started

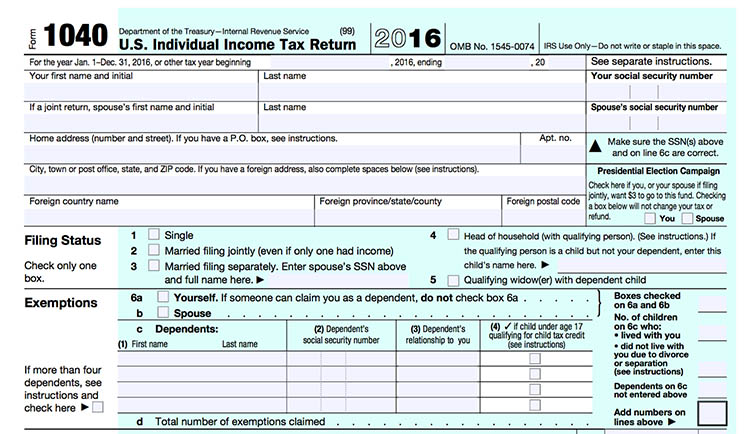

In order to claim expenses, you must first have an established business by taking these steps:

- learn about the various tax forms you need to fill out

- applied for a photography business license

- set up your photography business bank accounts

Photography Business Expenses and Tax Payments

- What are expenses?

- Photographer business expense categories

- How to keep track of business expenses

- Keeping track of business-related events

- Reconcile your accounts quarterly or monthly

- How I handle accounting on a regular basis

What are business expenses?

One of the benefits of running your own business is the ability to deduct business expenses from your tax payments. In a basic sense, an expense is a cost required for something. When it comes to your photography business, an expense is a cost that occurs as part of operating your business. There are two types of expenses: fixed expenses, and variable expenses.

Fixed Expenses

These are the costs that you will incur regardless of how many photoshoots you conduct throughout the year. Examples of fixed expenses would be the costs for liability insurance, camera gear, etc.

Variable Expenses

On the other side of the spectrum are variable expenses. These are the costs of doing business that will vary depending on how much work you do throughout the year. Examples would include the costs for travel, renting equipment, hiring a photography assistant, etc.

Photographer Business Expense Categories – 16 things you can write off

A photography business can deduct quite a few business expenses from its taxes. Below are some common photography business expenses sorted by category.

1. Advertising

Business cards, directory listings, advertising, brochures, flyers, marketing or consultant fees, building and hosting a photography website, business logo design, marketing e-mails, promotional events, sponsorships, banners and posters.

2. Business Travel

Air, train, bus fare, rental car expenses, hotel expenses, Uber and shuttle fares, gas, parking fees and tolls, computer or internet fees while away, phone calls, the cost of shipping baggage, supplies, the cost of storing baggage or luggage, etc. All of these fees must be incurred during business travel to qualify.

If you travel for business, many of those costs can be written off as expenses.

3. Meals and Entertainment

Meals while traveling on a business trip or entertaining business associates. This is capped at a 50% deductible.

4. Commissions

Sales commissions, fees for legal referrals, shared commissions, commissions paid to managers or agents that are not employees, fees to drop shippers, or fees for online referrals.

5. Communication

A business phone line, cell phone service for business, long-distance call fees, Internet service providers, video conferencing services, Internet routers, and modems, etc.

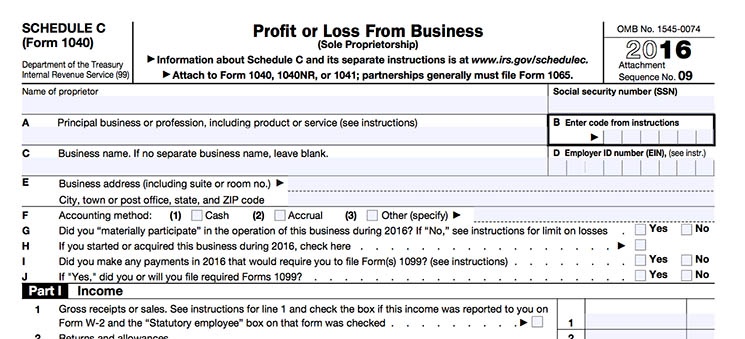

6. Contract Labor

If you paid an independent contractor/freelancer $600 or more for services on a project and didn’t withhold any taxes you need to send that contractor and the IRS a Form 1099-MISC. This could be part-time programmers for special projects, writers, designers, or second shooters.

7. Legal and Professional Fees

Business-related legal fees, association memberships (ie. PPA, WPPI), organization dues, accounting fees, short-term or one-time consulting fees for service such as management, marketing, bookkeeping, technical support, etc.

8. Insurance Payments

Health, long-term care, liability insurance, and photography equipment insurance are all eligible for tax writeoffs.

9. Interest Payments

Business credit cards, financial loans, and property interest.

10. Office Expenses

Services related to managing your office or photo studio space. Examples include backup data and archiving services, cleaning, furnishing, and membership fees to places like Costco where you regularly buy things for your use in your office.

11. Office and Photography Supplies

Pens, paper, printer ink and toner, stamps, mailers, flash drives, memory cards, shipping materials, storage and filing boxes, calendars, and planners, scissors, tape, etc.

12. Utilities

This would be gas, electric, water, trash collection. These expenses are only for your business office or studio. Home office utilities do not count as a business expense.

13. Repairs and Maintenance

Fees to fix your office space or equipment such as repairs of cameras or computers, maintenance of your studio space.

14. Rental Expenses

Computers, cameras, lenses, cameras, storage rental, studio space, vehicles to travel to photoshoot.

15. Taxes and Licenses

Business licenses and permits, professional licenses, real estate taxes for business property, incorporation fees, business name or search fees, copyright application and registration, trademark fees, etc.

16. Other Miscellaneous Expenses

Monthly software fees (ie. Adobe Creative Cloud, FreshBooks), bank charges, shipping and postage fees, business learning resources or classes, credit card or PayPal processing fees, conferences and conventions, start-up costs up to $5000.

How to keep track of business expenses

Business expenses are great in that you can deduct them from your federal taxes. The downside is that you have to keep track of your business expenses in order for them to qualify. Records you must keep include a receipt or proof of purchase and a note about the transaction’s purpose. Also, be sure to make all of your expense payments from a separate business bank account.

Option 1 – Spreadsheet

Some might prefer tracking their expenses and accounting activity with spreadsheets. If you’re looking for an expense spreadsheet template, check out the free download below.

Download: Business Expense Spreadsheet

Option 2 – Dedicated Expense Tracking Apps

Whether you use an iPhone or Android device, both app stores are full of expense tracking apps. Expensify is a great app that I used previously for tracking expenses. The feature I love the most is the ability to take a photo of a receipt and have it automatically transcribed into the app.

Check out Expensify in Google Play and in the Apple App Store.

If you drive a lot of business miles, I also recommend MileIQ. This is a standalone app that automatically detects and tracks your business mileage. I’ve been using it for years, and it is fantastic for tracking mileage. It is currently operated by Microsoft, so you have the reassurance that MileIQ will have long-term support.

Option 3 – Use your accounting software

Accounting software has grown to the point where they are offering many of the expense tracking features that the above-mentioned standalone apps have. This makes it compelling to consider using your accounting software as an all-in-one solution. FreshBooks, which I talked about in the last installment on starting your photography business, is a great option. Not only does it let you do bookkeeping and invoicing, but it can also automatically categorize your business expenses. This has been my go-to solution for tracking expenses for the past several years.

Keep track of business-related events.

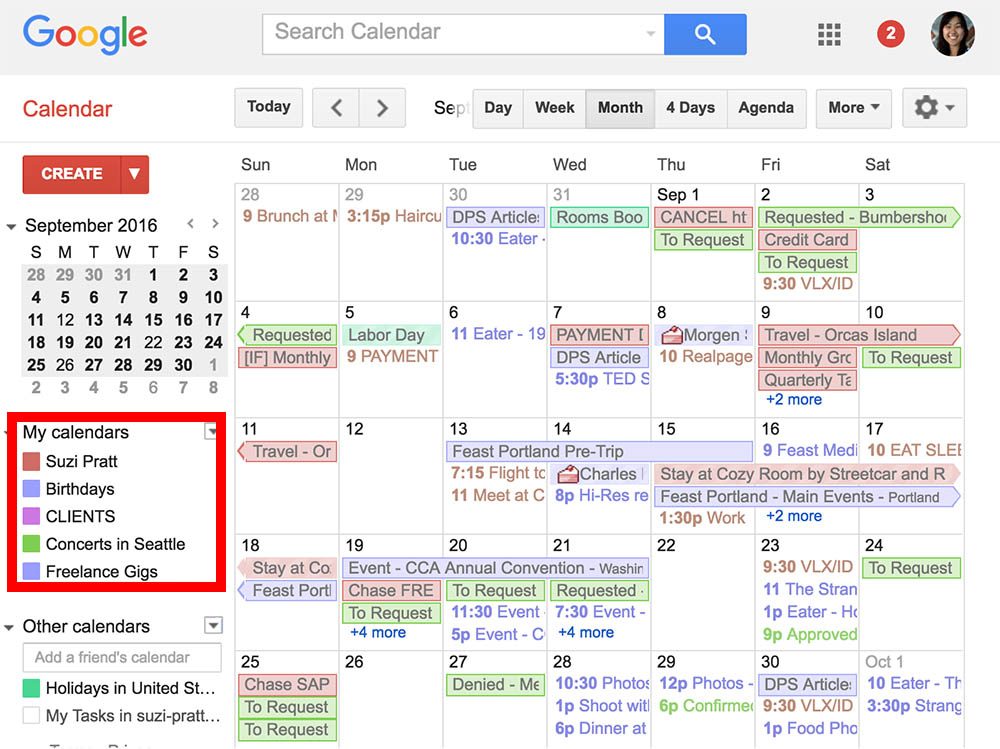

As a photography business, your calendar is your best friend. Google Calendar is a free solution that integrates with Gmail. I use it to input everything from daily schedules and routines to meetings and photo shoots. Besides helping with daily organization, you can search Google Calendar for past events to line them up with your photography business expenses. I set aside a couple hours every 2 weeks to go through my shoebox of receipts to input them into FreshBooks.

Take advantage of Google’s multiple calendar feature to color-code your events.

Reconcile your accounts quarterly or monthly

Sorting through 12 months worth of photography business expenses is not fun at all, especially when you’re on a deadline. I learned this the hard way during my first year of business as a photographer. I now sit down regularly with my FreshBooks account and make sure my business expenses are accounted for.

Consider hiring a professional bookkeeper

If keeping track of your photography business expenses seems tedious, you have two options to help:

- use accounting software such as FreshBooks

- hire a professional bookkeeper to do it for you

Set aside 15% of your income for tax payments.

Tax rates vary. Generally, 15% of your sales or income is a good amount to set aside. Doing taxes for the first year of my photography business was painful. I filed annually that year and wrote an enormous check to the IRS. As a result, my tax preparer set my business up so that I make my tax payments in quarterly installments. It’s your choice whether you choose to pay your business taxes annually or quarterly.

Apply sales tax where necessary

Whether you charge a client sales tax depends on the business you run. In general, creative services will not have to worry about sales tax since they offer a service. However, say your client orders and receives something physical like a photo album or thumb drive of images. At this point, your photos have become products. A good rule of thumb is to charge your photography service as one item without sales tax and charge the product separately with sales tax included.

Handling your accounting and finances on a regular basis leaves more time for doing what you love: shooting photos.

Tips to Handle Accounting / Bookkeeping on a Regular Basis

For most photographers, it’s not realistic to do bookkeeping every day. But you should sort through your photography business expenses regularly. This is how I handle my business bookkeeping:

Daily

- Charge all business-related expenses using my business credit card

- Save business expense receipts in a central location (for me, it’s a shoebox).

- Input all business activities and appointments into Google Calendar with details (ie. who you’re meeting, why, and where).

Every 2-4 Weeks

- Sit down with FreshBooks and update all bank transactions.

- Properly organize and file away business expense receipts.

- Reconcile all Google Calendar and MileIQ activities

Every Quarter (3 Months)

- Input tax due dates and set reminders on Google Calendar

- Send in quarterly business tax payments via snail mail.

Every Year

- Email my tax preparer and give him access to my FreshBooks account

- Tax preparer files my annual tax returns and sends me the summary

- Federal tax return due dates: For split corporations, federal taxes are due March 15; sole proprietors or individual LLC have a federal tax due date of April 15.

In Summary

Tracking photography business expenses is tedious, but it’s a part of doing your taxes legally. Use the resources and tips above to help set up a solid system for your new business. Any other resources you would recommend? Let me know in the comments below.